Smarter Portfolios

Excellence in Investing – For Advisors and Their Clients

Modern investing is changing.

Advisors are looking for a new investing solution – one that enables them to scale their capacity while providing highly personalized client experiences.

A platform built for advisors to deliver exceptional clarity and customization to their clients.

“WealthPlan has the most flexible and most innovative platform I’ve seen in the entire industry.”

- Wayne Wagner Jr., ChFC Vizionary Wealth Management

Investing for a Return on Life

Clients have unique investment goals and objectives that change in each season of life. As you anticipate their needs, we are here to help you align their investment strategy.

Wealth Accumulation

& Growth Planning

Asset Management

Savings/Growth

Insurance Planning

Monte Carlo Stress Testing

Transitional

Planning

Asset Protection

Income Planning

Legacy

Planning

Asset Preservation

Income Needs

Estate Planning

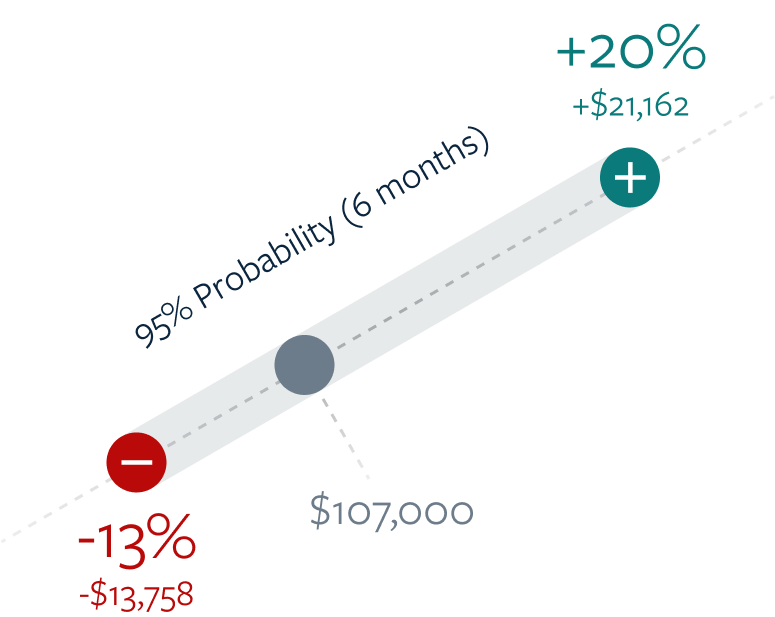

Defining Drawdown Risk

The old way of simply checking a box and stereotyping investors with subjective semantics simply doesn’t work. Terms like conservative, moderate, or aggressive fail to consider loss. Our risk analysis focuses on how much downside an investor is comfortable with.

Our goal during this process of building your Wealthplan blueprint is to allow you to pinpoint your risk number by selecting how much "downside" you are comfortable with.

Data-Driven Risk Management

Set client expectations with clear potential ranges of returns that fit their risk budget. Rather than focusing on historical returns WealthPlan leverages a risk process using tiered strategies to meet individualized needs of every investor.

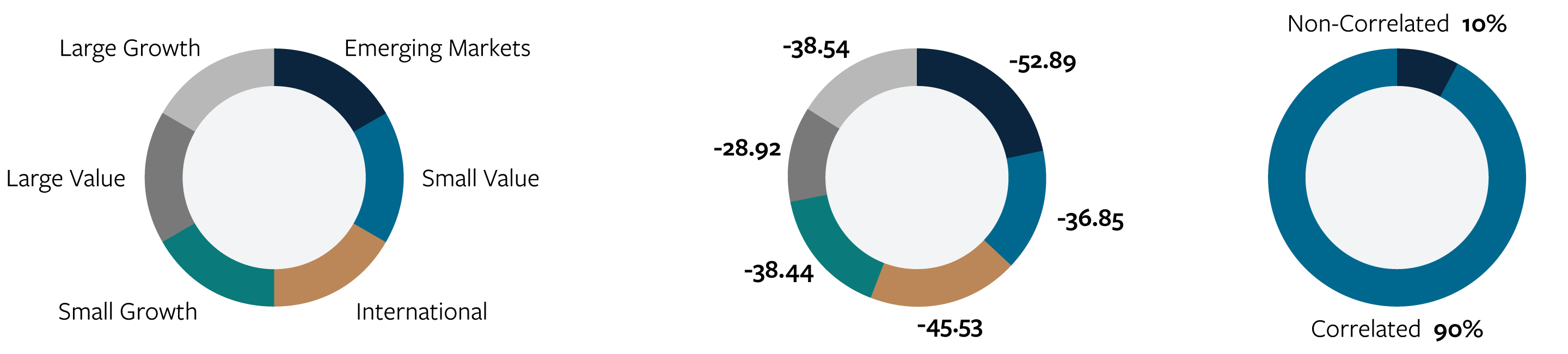

When it comes to diversification,

we question tradition.

Traditional asset allocation appears to provide a diversified portfolio comprised of asset classes. However, this so-called “diversification” typically fails during a downmarket event, such as between January 1, 2008 and December 31, 2008 (pictured below). Correlation reveals that the portfolio isn’t so diversified after all.

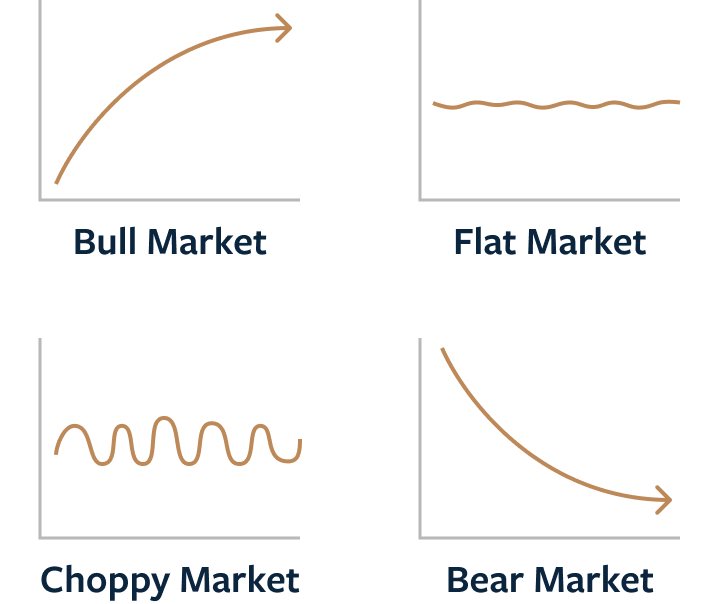

A lineup of Investment strategies, some better suited for up markets and some for down markets, are incorporated at statistically optimal weights through a proprietary full-scale strategy diversification process.

By creating this optimal mix, the diversified blend of methodologies creates a portfolio that is designed to dynamically adapt to changing markets.

Growth Stock Momentum

Tactical Trading

Lower Cost Indexing

Real Estate Lower Turnover

Dividend Income

Active Management

Tactical Management

Higher Yielding Income Event

Driven Inflation Protection

Income Focused Investments

Absolute Return Low Correlation

“Alternatives” Real Assets

Individual Strategies

Each of these asset classes serve as a building block to help you construct

the ideal portfolio for your clients' needs.

Managed Equity

An all-equity strategy that focuses on capital appreciation. The strategy employs a diversified mix of equity securities that seek to provide relative outperformance to equity market indices.

Defense Equity

strategies include equity investments with defensive mechanisms such as tactical market exposure with downside protection or long-short strategies that attempt to reduce portfolio volatility.

Yield Producers

strategies invest in income-oriented investments such as bonds and bond funds with lower correlation to equity markets.

Alternatives

diversify from traditional asset classes, such as equities and fixed income into investments such as managed futures and market-neutral strategies to dampen portfolio volatility.

Dividend Aristocrat

An all-equity strategy that invests in individual companies with track records of recurrent and prospective dividend growth seeking to provide a consistent, rising income stream over the investment horizon. The strategy predominately invests in companies that have paid and raised dividends for 25+ straight years.

Select Equity

An all-equity strategy with an objective towards long-term growth. This invests in a concentrated portfolio of high-quality businesses that are determined to have sustainable competitive advantages, strong growth potential, and reasonable assessed valuations.

Buffered Equity

Equity strategies that allow investors to participate in market growth while maintaining buffers on downside market volatility in exchange for limits on upside participation.

Smarter Strategies

You can build your own or select from our strategies designed to

accomplish specific investment objectives.

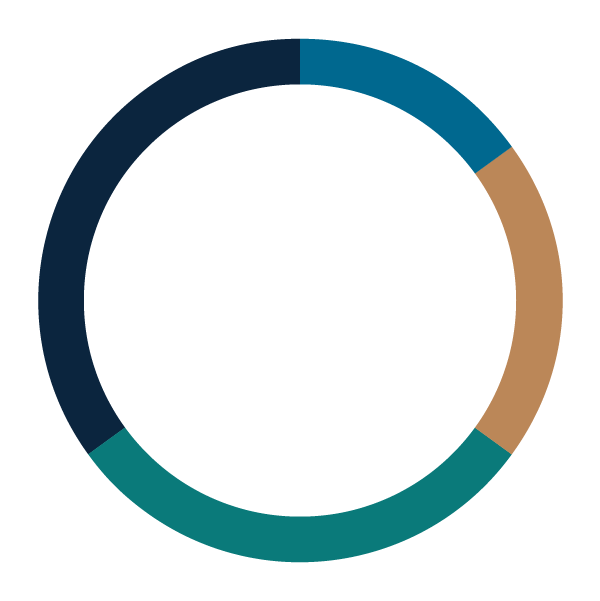

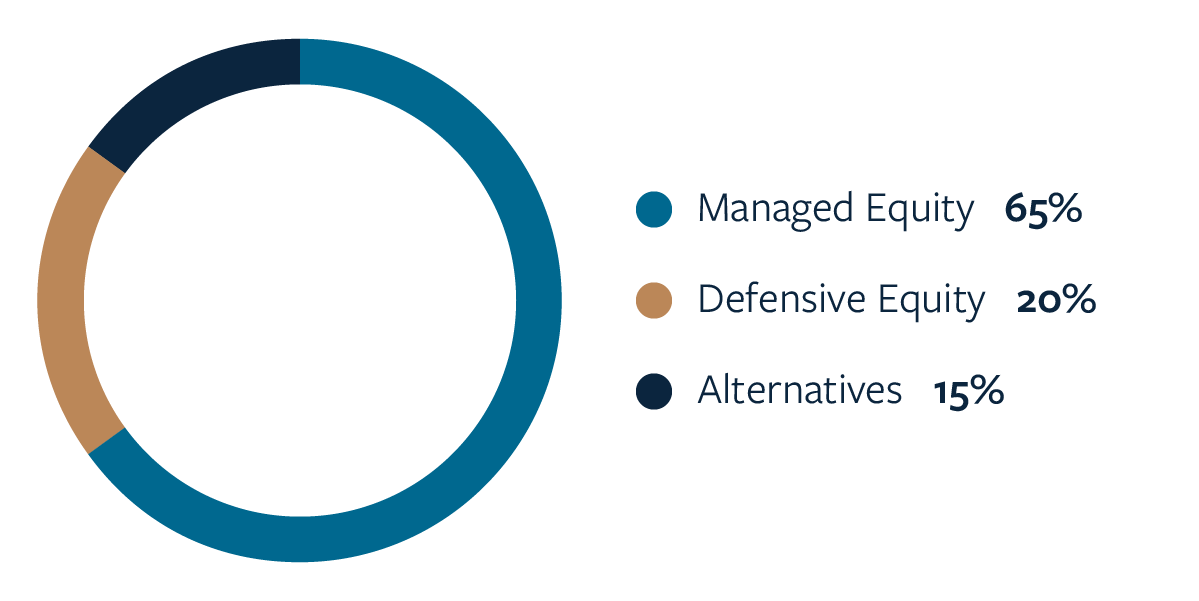

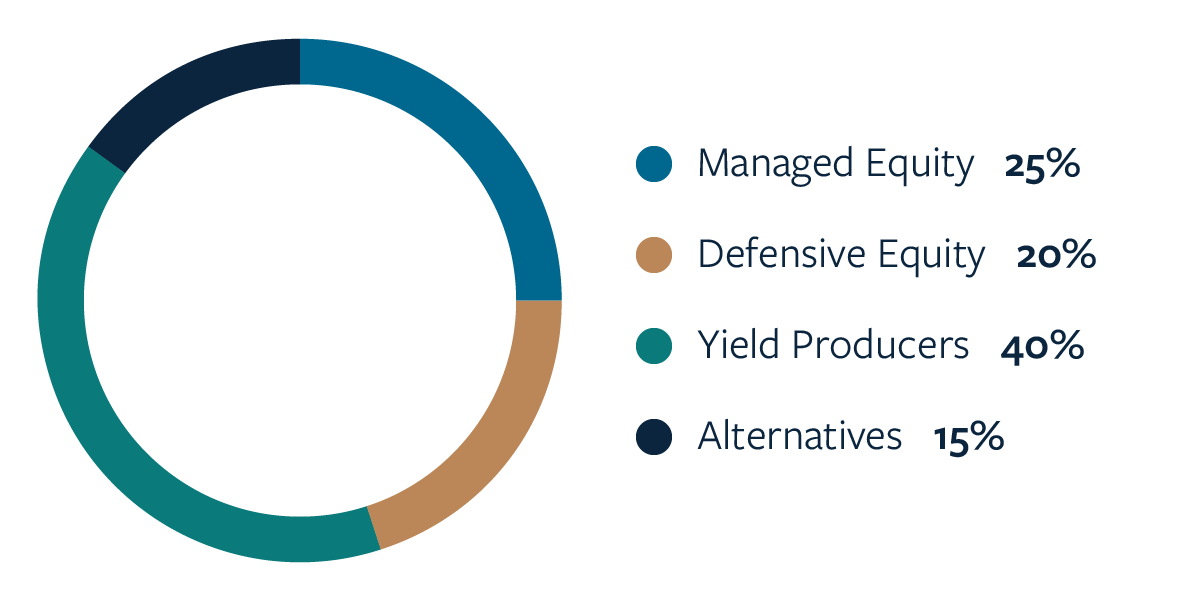

All Appreciation

A diverse set of investment strategies designed to generate long-term capital growth predominately through exposure to equity holdings. Defensive equity and alternative asset holdings are also included in the portfolio to help reduce overall portfolio drawdown in volatile markets.

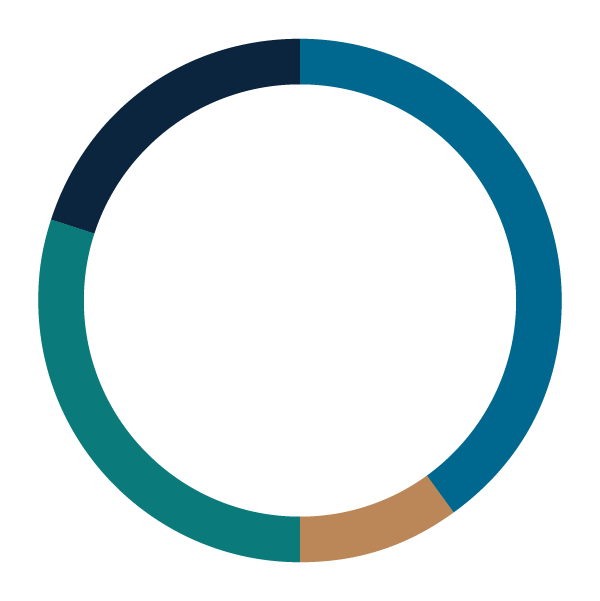

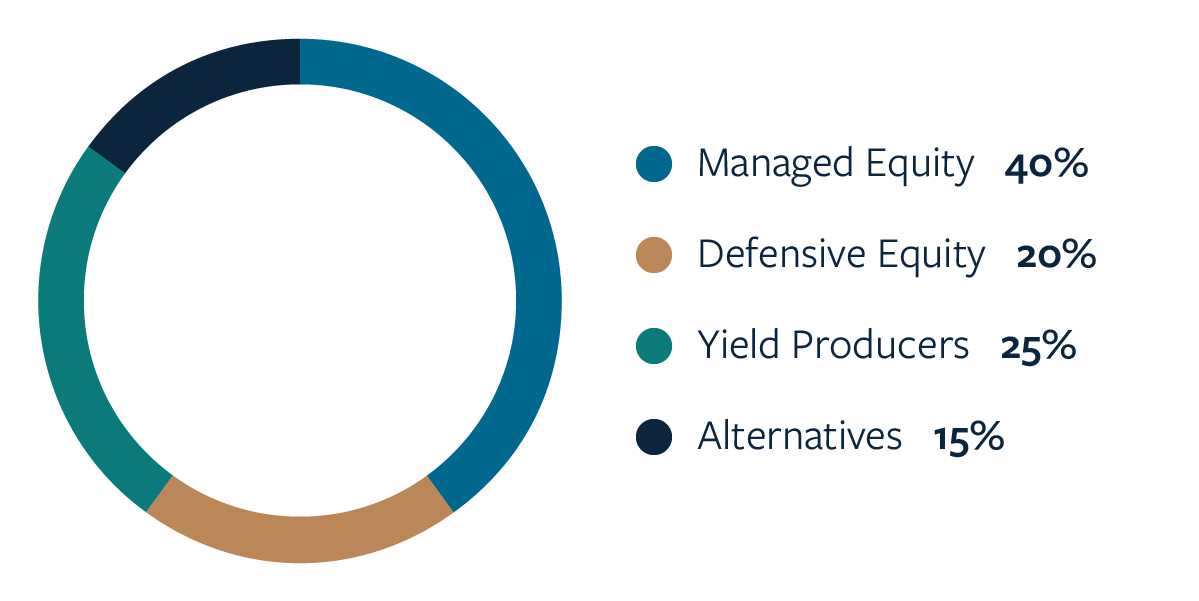

All Weather

A diverse set of investment strategies designed to generate a risk-conscious, long-term growth of capital while reducing drawdown exposure for capital preservation. Strategies include the use of equity, fixed income and alternative asset holdings, with sever al strategies that utilize risk-management techniques to help reduce overall portfolio drawdown.

All Income

A diverse set of investment strategies designed to generate a moderate, risk-conscious growth of capital with preference to hig her current income. Strategies include the use of fixed income, equity and alternative asset holdings that target an above-average current yield with several strategies that utilize risk-management techniques to help reduce overall portfolio drawdown.

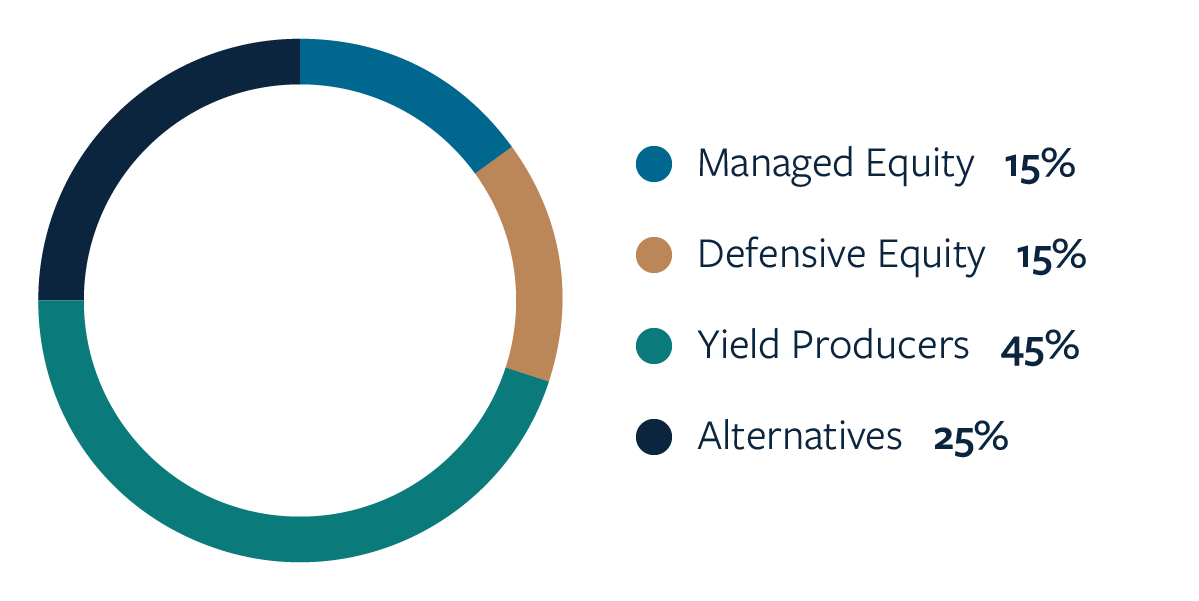

All Risk Hedged

A diverse set of investment strategies designed to generate risk-conscious preservation of capital with a secondary objective towards tactical growth & income. Strategies include the use of fixed income, equity and alternative asset holdings that target low cumulative equity risk exposure and a higher mix of alternative investments.

Communicating

Investments

Access Powerful Resources Without Sacrificing Independence

Erik Ogard, CFA

“Being a successful planner and advisor requires a great deal of client-focused effort, which leaves little time for investment-related activity. Doing both well is extremely difficult and inevitably something falls through the cracks.

To deal with this reality, WealthPlan Group has assembled a team of experienced investment professionals, freeing each advisor to do world-class planning and grow their individual practice.”

Sarah McLeann

“The vision of WealthPlan Group is to give independent advisors access to resources at scale. You keep your independence and gain a leverage-friendly partner to help you grow.”

If you want to learn more about how WealthPlan Group can help facilitate your investment management, get in touch to learn more.